Earlier this week, a J.P. Morgan analyst memo referenced a declining number of companies citing “pricing power” as a tailwind in Europe.

From a quantitative perspective, they measured the number of mentions of pricing power in company transcripts and it is now well below average. And this was also spanning across different industries (automotive, pharma, aircraft, chemicals), therefore not a sector specific issue. A similar development is likely to affect the North America market next.

Looking at the broader picture, this development is unwelcome, but not surprising:

- The pricing tailwind following the Covid19 supply interruptions and mismatched demand/supply is dissipating.

- Energy deflation, partly offset by salary and logistics increases translates to slowing inflation.

- Increased international imports, particularly from China, create a tougher competitive environment.

Fortunately, not all the metrics are down trending, leaving many pockets of pricing power, if you know where to look for them.

Here are some recommended steps to combat impending pricing pressures:

- Negotiate vendor cost down quicker than customers do with you. It is a no brainer, but many companies lose the battle by moving too slow and in a narrow fashion.

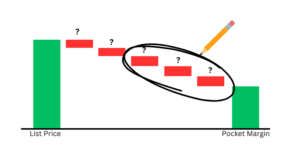

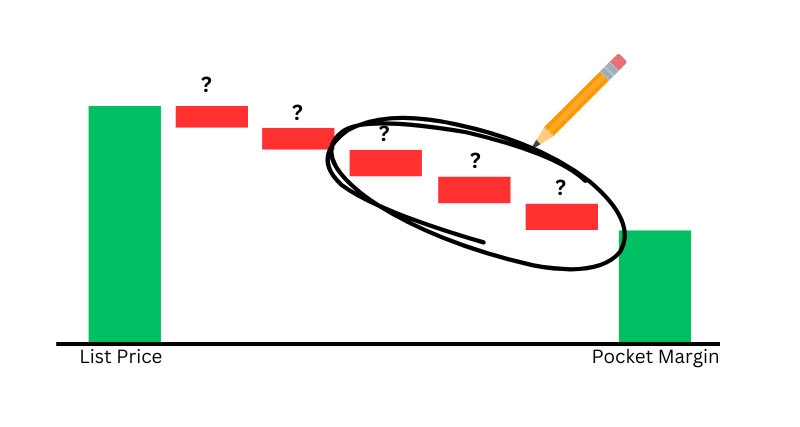

- Elevate your price and margin metrics to the next level: you cannot detect “death by 1,000 cuts” if you are looking at your pricing at an aggregate level only. Well, you can, but you will realize way too late in the game that you have a MASSIVE problem on your hands. Instead, keep a sharper eye on developing trends from the bottom up, which will allow you to rectify profitability issues before they escalate.

- Manage price and volume with renewed intensity: if you are making short term price concessions in exchange for volume, make sure that incremental volume materializes. With potentially slower demand and economic backdrop, the promise of volume may be unfulfilled. Therefore, if you must concede price in exchange for volume, try at least to structure it around a rebate program: this will allow you to first win the volume, then concede the discount.

With slower inflation and potentially a softening market environment in the future, pricing remains a key business lever. In other words, it is time to step up your pricing game. Please reach out if you need assistance.