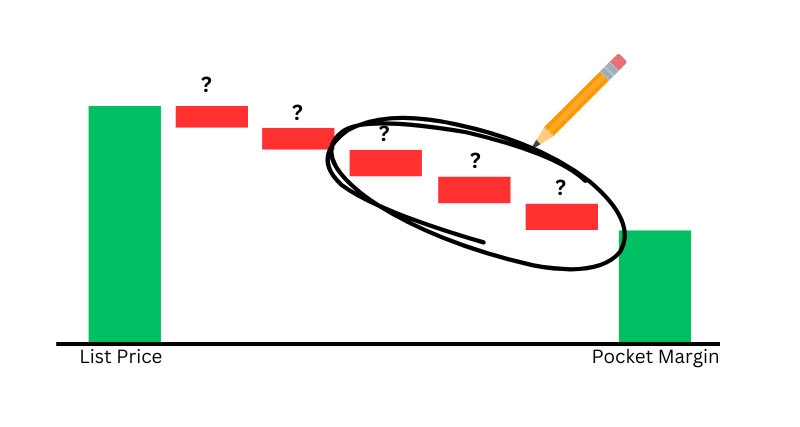

In today’s competitive environment, companies are constantly pushing to differentiate themselves. With the rapid pace of business, it’s all too easy to overlook hidden costs—and these can quickly erode profits. Enter the Pocket Price Waterfall, a concept popularized by McKinsey in 2003 (link here, requires sign in), which illustrates how various concessions, discounts, and services chip away at your list price until you’re left with an actual “pocket price”—often lower than you think. Done well, measuring and managing your waterfall can help capture an additional 1% (or more) in profits. But many organizations struggle to take advantage of it.

Below, we’ll break down the components of a pocket price waterfall and walk through a four-step process to help you pinpoint—and prevent—profit leakage.

Understanding the Pocket Price Waterfall

- Target Price (or List Price)

This is the published price you’d like customers to pay, or your starting price from which to discount from.

- Invoice Price

The price stated on the customer’s invoice after applied discounts and promotions. While this is often considered the “selling price,” additional non-invoiced costs still exist.

- Pocket Price

This accounts for concessions not shown on the invoice—such as rebates, extended payment terms, waived emergency shipping charges, or change orders. These costs can be contractual or unplanned, yet they ultimately reduce the revenue you keep in your pocket.

- Pocket Margin

Even after arriving at the pocket price, you may face further customer-specific costs like specialized equipment, on-site technical service, third-party storage, and more. These hidden expenses can continue to erode profitability.

Why Companies Struggle to Measure the Waterfall

- Business Silos

Waterfall components often span multiple departments—Sales, Customer Service, Logistics, Finance—making it difficult to pinpoint who “owns” the costs. Take freight, for example: how much of it is discretionary vs. contractually guaranteed? And how much of it is a hidden cost incurred simply because internal processes aren’t streamlined? Untangling this web can be complex when so many functions are involved.

- Missing or Unattributable Data

Many of these waterfall costs are buried in consolidated invoices or broad overhead accounts. Even if detailed data exists, it’s often not aligned by customer, order, or product. Take the case of outsourced logistics (3PL): shipping costs might be grouped in a lump-sum invoice, making it nearly impossible to trace to specific customers or transactions. Without clarity, managing profit leakage is guesswork at best.

Conquering the Waterfall: A Four-Step Guide

Step 1: Identify the Root Causes

Before making any changes, figure out why a cost is being incurred. Is expedited freight happening because the customer demands it—or because your planning process forces rush orders to meet promised dates? Who’s granting certain discounts or rebates, and what value does the customer actually gain from them? Pinpointing these causes helps you decide whether to address an internal issue (e.g., poor planning) or negotiate better terms with the customer.

Step 2: Understand the Constraints

Next, determine what’s discretionary versus contractually required. Some rebates, service hours, or shipping policies might be baked into contracts, making them harder to eliminate without customer backlash. In other cases, certain concessions have become industry norms—charging for them could drive customers away if all competitors provide them for free. Conversely, you may discover “blind spots” like a well-intentioned customer service team offering the “last price paid” post–price increase. These policies can quietly accumulate into massive profit leakage.

Step 3: Capture the Leaked Profits

After you’ve isolated the root causes and understood the contractual or industry constraints, create a plan to address them. This could mean:

- Preventing it: instituting new policies or internal changes so the cost never arises in the first place.

- Recapturing it: charging for a service when it’s reasonable and aligns with customer expectations.

Communicate your changes clearly, both internally and externally. Give customers enough notice to adapt and provide them with alternative options to avoid extra fees if possible. Internally, ensure your teams are trained and aligned on updated policies, ideally also incentivized in a way that prevents the profit erosion.

Step 4: Measure and Adjust

Finally, track the waterfall on an ongoing basis to ensure you’re capturing the expected savings. This isn’t a one-time project—you’ll need to review regularly because new leaks will inevitably appear over time. Stay vigilant and repeat the process every couple of years (or more frequently if your market changes rapidly) to keep profit drains in check.

Getting Started

Pocket Price Waterfall analysis will identify previously overlooked costs, helping you recapture lost profits and strengthen your bottom line. But it requires cross-functional collaboration, robust data, and clear communication.

If you need help dissecting your waterfall and implementing sustainable changes, please reach out. We can guide you through every step—from uncovering the hidden costs that erode your margins, to building a long-term strategy that empowers teams and drives profitability.