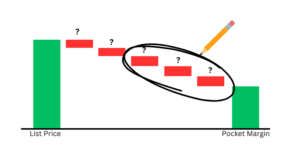

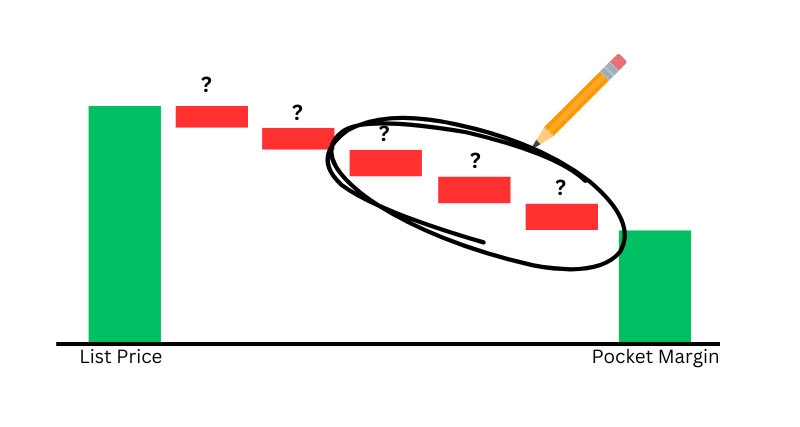

As businesses seek more tailored ways to align their products and services with customer needs, pricing strategies have evolved significantly. From simple cost-plus methods, where price is calculated by adding a margin to production costs, to value-based pricing, which considers perceived customer value, companies have continually adjusted their approaches to remain competitive and maximize profitability.

The next frontier of pricing is known as “outcome-based pricing”. In this approach, customers pay based on the results or outcomes they achieve, rather than the product or service itself. This shift represents a fundamental change in how businesses capture value, and many companies are working to adopt it. However, while the potential benefits are clear, implementing outcome-based pricing brings significant challenges.

What is Outcome-Based Pricing?

Outcome-based pricing links the cost a customer pays directly to the success metrics or specific results they achieve from using a product or service. Instead of charging a flat fee, companies charge based on tangible outcomes, such as improved efficiency, increased revenue, or other measurable KPIs that align with the customer’s goals.

For example:

– In healthcare, a company might charge hospitals based on the recovery rates or reduced readmissions resulting from their medical equipment or services.

– In software, a provider might base charges on the number of bugs resolved, customer satisfaction scores, or productivity improvements gained by using the platform.

– In energy, companies could charge based on a reduction in energy consumption or emissions rather than simply selling the equipment or technology.

– In recruiting, a vendor may charge based on number of open positions filled and their performance and tenure within the company.

This model creates a shared risk and reward structure, fostering a partnership between the provider and the customer, and aligning incentives more closely with customer success. More importantly, it requires both parties to truly understand which value is created and strongly align the pricing structure accordingly.

Why Companies Are Moving Towards Outcome-Based Pricing

1. Enhanced Customer Value Alignment: By linking pricing to customer results, companies can show their commitment to helping clients succeed. This customer-centric approach helps foster trust and long-term partnerships. For example, a customer would not be charged anymore for 100 software licenses if only 30 power users leveraged the application. In addition, the pricing would be geared toward the benefit those 30 users are experiencing.

2. Competitive Differentiation: Outcome-based pricing can help companies stand out from competitors offering traditional models. Customers increasingly appreciate pricing structures that align with their success, making this an attractive value proposition. It also becomes more difficult to compare apples-to-apples with competing offerings, since the outcome-based pricing goes beyond from just supplying a product or a service: it’s geared towards solving a customer need in a quantifiable way.

3. Lower Customer Risk: Customers that are concerned about the effectiveness of the vendor solution love the concept, since if they don’t receive value, they are not charged. This raises the emphasis on the vendor to ensure the customer is utilizing the solution and reaping the benefits which were promised. It can also lower the complexity for a customer: for example, Hitachi Rail uses outcomes based pricing and therefore converts the very high capital cost of trains and infrastructure into a “per use” operational expense. Their compensation is then also tied to performance and efficiency improvements, meaning that as the customer receives better on-time and reliable train service, Hitachi Rail will earn a portion of those benefits.

4. Improved Revenue Potential: For companies that deliver significant value, outcome-based pricing can be more profitable than traditional methods. Successful outcomes can drive customers to pay more, especially if they see measurable improvements in their operations or ROI. Wellness company NOOM prices corporate wellness programs aligning their pricing with the health outcome of participants into their program. Since the charges increase as customers improve their health, it creates a positive drive for NOOM to continue improving their research and quality of the solutions, eventually leading to better customer outcomes.

5. Increased Customer Loyalty: Customers are more likely to remain with a provider who actively works to help them achieve their desired results. Outcome-based pricing motivates both the customer and provider to maximize the impact of the product or service, which can enhance loyalty and reduce churn. Companies such as SalesForce and Costco have worked hard on customer retention initiatives, reaching levels of 91% retention, which is best in class.

Key Challenges in Implementing Outcome-Based Pricing

On paper, all of these benefits would drive every company towards outcome-based pricing. However, in spite of these benefits, it is also complex to execute and therefore slow to materialize. Here are some of the main challenges companies face when adopting this approach:

1. Defining and Measuring Outcomes

One of the biggest hurdles is defining clear, measurable outcomes that both parties agree upon. For outcome-based pricing to work, both the company and customer must agree on what constitutes success and how it will be measured. This can be straightforward in some cases but becomes difficult when outcomes are subjective or involve multiple variables. For example, a software provider might promise to improve productivity, but productivity can be influenced by several factors beyond the software itself. Or a company that promises incremental sales growth may not deliver those results in case of a market downturn.

2. Risk of Variable Revenue Streams

With outcome-based pricing, companies may face fluctuating or uncertain revenue streams. If customers do not achieve the desired outcomes, the company may receive less or no payment, affecting cash flow and profitability. This variability can be risky, especially for smaller companies that depend on predictable revenue. Firms must have confidence in their ability to consistently deliver measurable outcomes and manage the financial implications of variable pricing. On the customer side, also pricing will vary over time, making planning more difficult. In theory, if pricing is increasing it means the customer is more than receiving the relative value improvement, so it should be self-funding. Nevertheless, this raises complexity in budgeting and planning.

3. Data Collection and Analytics

Implementing outcome-based pricing requires robust data collection and analytics capabilities. Companies need to track and measure outcomes continuously, often through sophisticated monitoring systems. For instance, a company offering outcome-based pricing on energy-saving technology must be able to measure energy consumption accurately and reliably. Developing and maintaining these systems can be costly and resource-intensive, requiring expertise in data science and analytics. In addition, the metrics should detect short-term improvements: it would be difficult to manage a pricing structure if customer benefits are not visible for six months or longer.

4. Establishing Trust and Communication with Clients

Outcome-based pricing relies on a high degree of transparency and partnership. Clients need to trust that the provider is accurately measuring and reporting outcomes. This requires frequent communication, clear contracts, and ongoing collaboration. Establishing these practices can take time, and any breakdown in trust or communication can jeopardize the relationship. On the customer front, the vendor needs to trust that the customer is not downplaying the value received from the vendor. Clear contracts and regular touchpoints are essential to maintain alignment on goals and ensure that both sides are satisfied with the process.

5. Complex Sales and Negotiation Processes

Transitioning to outcome-based pricing often requires a shift in sales strategy and negotiation practices. Sales teams may need to work more closely with customers to understand their goals and challenges and to co-create success metrics. This approach is more complex than traditional sales processes, which focus mainly on price and features. Additionally, negotiating the terms of an outcome-based contract can be lengthy, requiring both sides to agree on fair and attainable metrics.

6. Adapting Internal Processes and Incentives

Internally, companies must align their teams and operations with the outcome-based pricing model. This might involve adjusting team incentives to focus on customer success rather than just sales or delivery. It also means ensuring that everyone, from product development to customer support, is focused on achieving measurable outcomes for customers. Aligning internal processes and metrics to this model is challenging and may require significant organizational change.

Final Thoughts

Outcome-based pricing represents an exciting frontier in the evolution of pricing strategies, providing companies with a way to build deeper relationships with customers, stand out from the competition, and potentially boost revenue. However, transitioning to this model isn’t easy. It requires a commitment to customer-centricity, advanced data capabilities, and a willingness to share risk with clients.

Companies looking to adopt outcome-based pricing should begin by piloting it with select clients and refining their approach based on real-world experiences. Success in outcome-based pricing lies in balancing ambition with careful planning, ensuring that the company is ready to deliver—and measure—outcomes that matter to customers.